While inflation rose, this asset quietly averaged 12.6% a year over the past decade*

Build a portfolio of investment-grade artworks from just £5,000

37.8% Return

1 Years Held

Basquiat

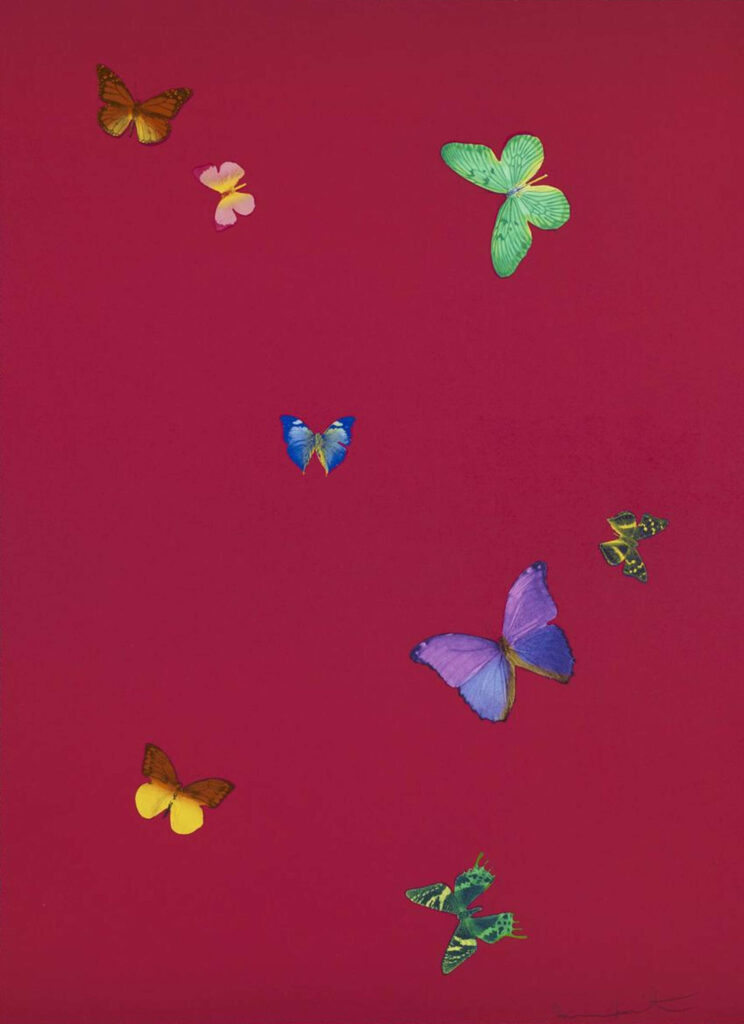

66.6% Return

2 Years Held

Damien Hirst

129% Return

5 Years Held

Banksy

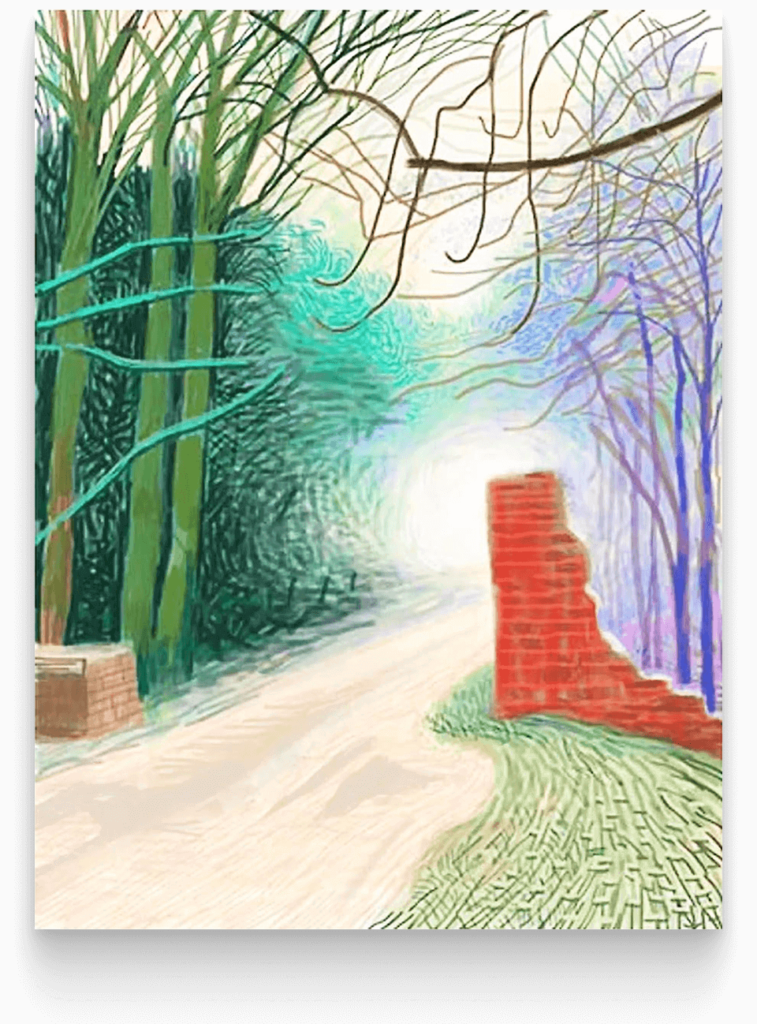

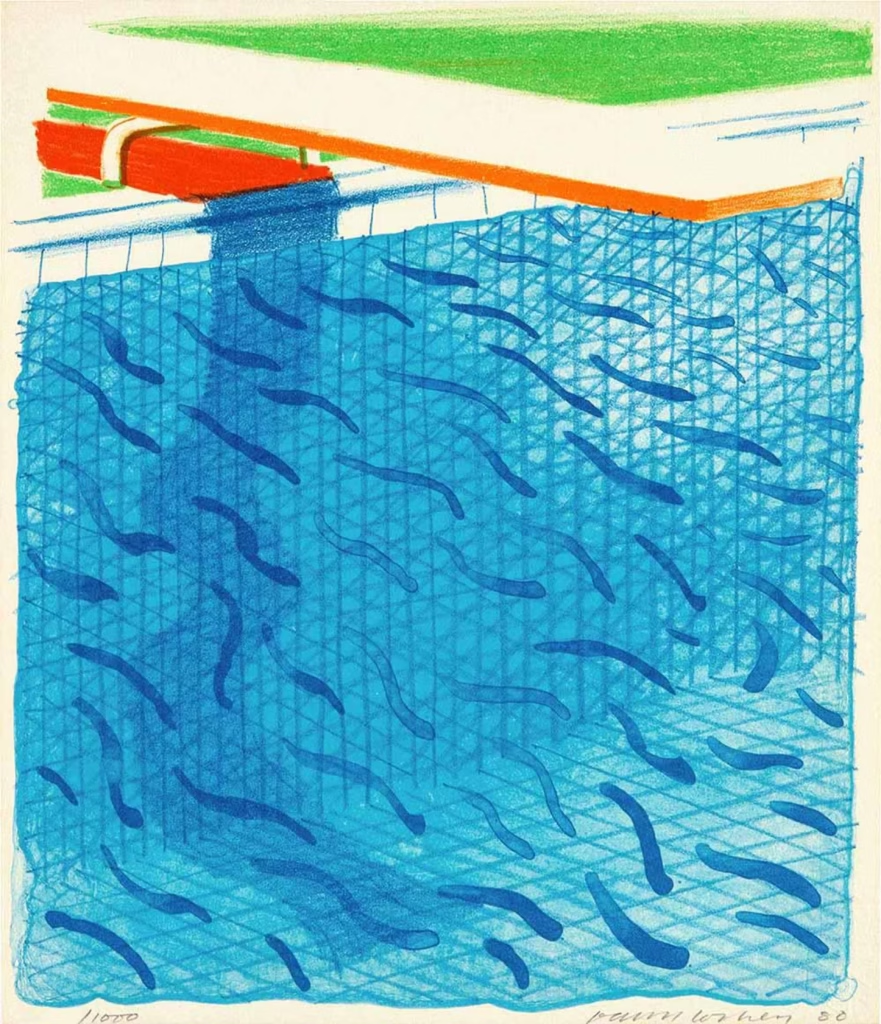

227.6% Return

3 Years Held

David Hockney

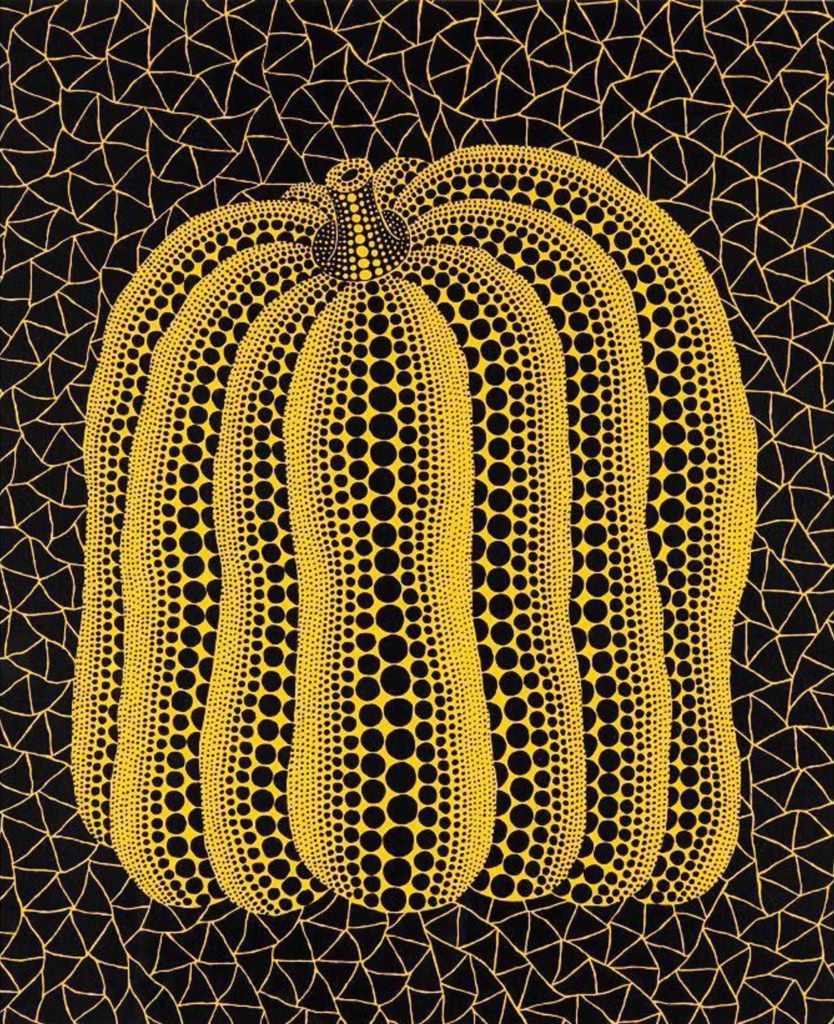

81.5% Return

4 Years Held

Yayoi Kusama

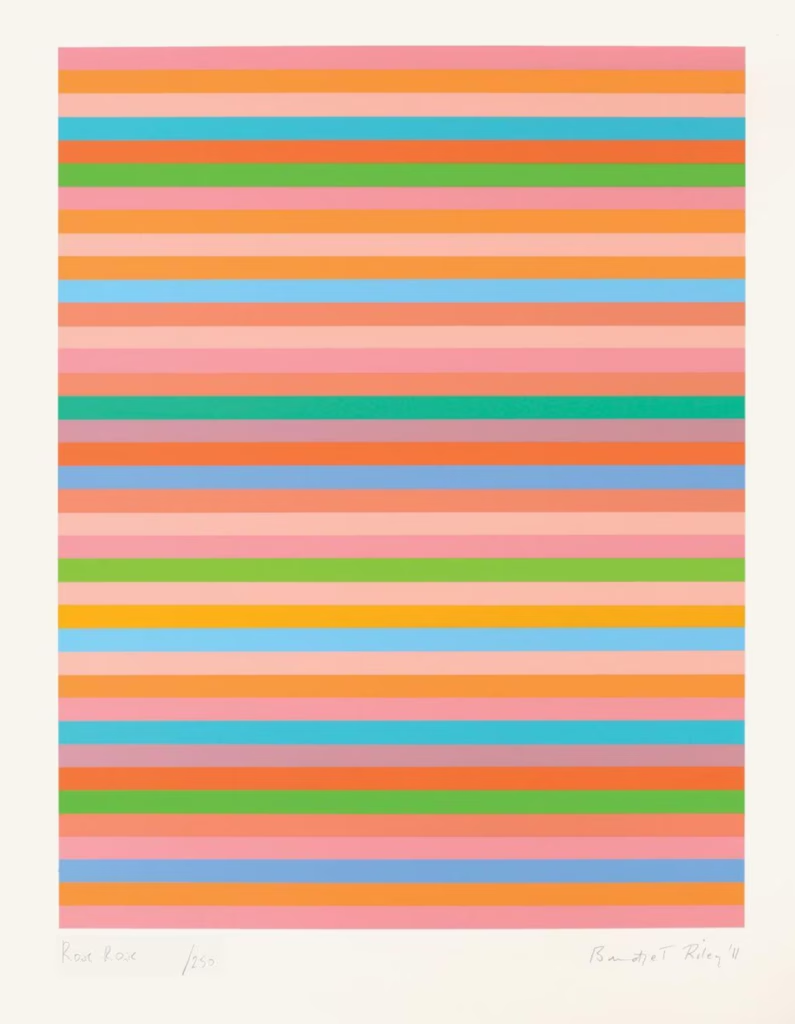

55.7% Return

3 Years Held

Bridget Riley

90.4% Return

4 Years Held

Andy Warhol

42.9% Return

5 Years Held

Roy Lichtenstein

*12.6% per annum figure based on findings by Pringle between 1995 and 2022 Fortune and does not guarantee future or indicative performance.

Art investments are unregulated in the UK.

The value of investments are variable and can go down as well as up.

Past performance does not guarantee future performance.

Why Invest

in art

Why Invest in art

The Art Market

is On The Up

and Up

Contemporary art has surged 2,200% since 2000, outperforming traditional markets demonstrating long-term resilience.

Excellent Diversification Opportunity

Fine art moves independently from traditional markets, reducing overall investment risk, making it a strong portfolio diversifier.

Art Can Outperform the S&P 500 & Gold

Blue-chip art has delivered annualised returns of 12-14% over the past 25 years, consistently outperforming the S&P 500 and gold.

Inflation

Protection

Art has historically outpaced inflation—between 2021 and 2023, prices surged 22%, beating property and commodities.

Download our exclusive Art Investment Guide and discover how to navigate the art world, build a valuable portfolio, and turn passion into profit.

Get your art investment guide

Get your

Art

Investment

Guide

Hear from ourClients

They just get what I want. Unlike other galleries where it’s ‘take it or leave it,’ Crusoe is flexible, knowledgeable, and has a different approach. I’ve had commissions before where you never even meet the artist, but with Crusoe, you’re part of the process—you get proofs, you give feedback, and the final piece is exactly what you wanted. I can call them with an idea and within hours or days, they’ve found exactly what I’m looking for. Nine times out of ten, you don’t even know a piece is available—but Crusoe will go and find it.

Just do it. Just work with them.”

“I’ve worked with Crusoe Contemporary for about 18 months now, and every painting has been an easy purchase”

Inside our

Art Investment guide

1

Understanding Art as an Asset

2

Navigating the Art Market

3

Evaluating Art for Investment

4

Building an Art Portfolio

5

Managing Your Art Investments

6

Exit Strategies

Art Investment

Statistics

Blue-chip art has seen consistent growth, with Post-War & Contemporary Art appreciating by 12.6% annually.

The global art market reached $65 billion last year, driven by high demand for limited-edition and blue-chip works.

Price rise of art increased during 10-year period by the Knight Frank Luxury Investment Index